Stock option tax calculator

Stock Options Final Year Values After 15 years at 7 options are worth 138 Definitions Current stock price Current stock price. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high.

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

The Stock Option Plan specifies the total number of shares in the option pool.

. Ad Trade with the Options Platform Awarded for 7 Consecutive Years. On this page is a non-qualified stock option or NSO calculator. Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies.

How Does Stock Tax Calculator Work First of all you provide the. Open an Account Now. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Basic Long Call bullish. The following calculator enables workers to see what their stock options are likely to be valued at for a range of potential price changes. Heres a real-life example.

To start select an options trading strategy. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Calculators Recurring Deposit Calculator Fixed Deposit.

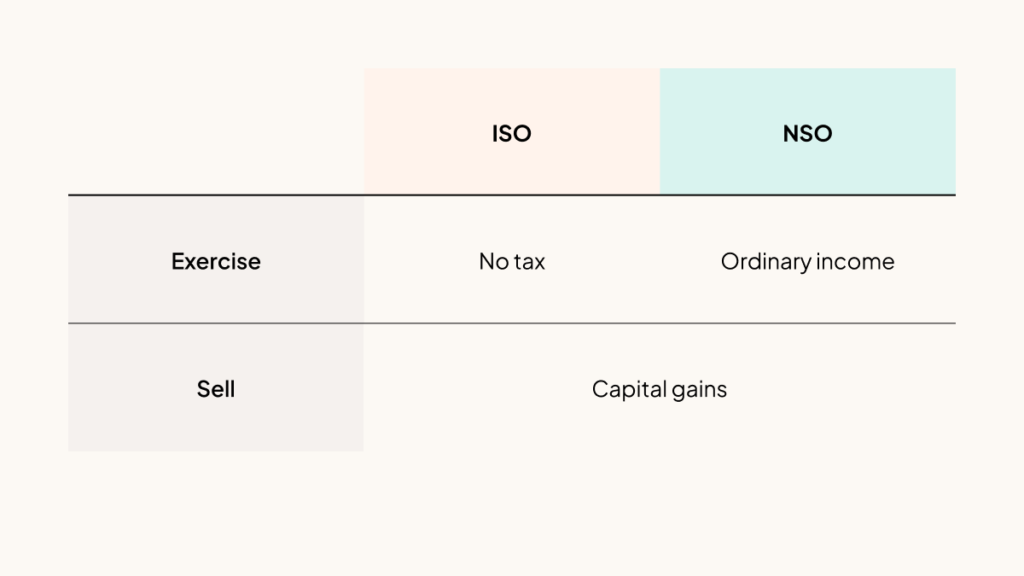

How much are your stock options worth. January 29 2022. On this page is an Incentive Stock Options or ISO calculator.

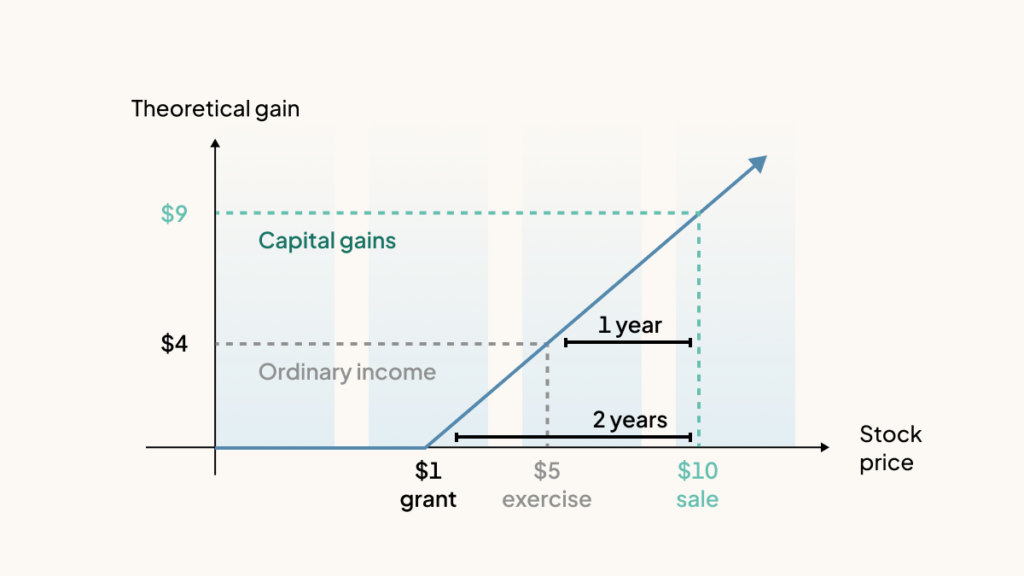

In our continuing example your theoretical gain is. Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Stock option exit calculator See how much your stock could be worth See how much you might potentially bring home if your company IPOs or exits.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The tool will estimate how much tax youll pay plus your total return on your. New Look At Your Financial Strategy.

Open an Account Now. Ordinary income tax and capital gains tax. Please enter your option information below to see your potential savings.

This online calculator will calculate the exact amount of tax that you owe considering all the factors mentioned above. Enter the current stock price of your company the. Our Stock Option Tax Calculator automatically accounts for it.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. This permalink creates a unique url for this online calculator with your saved information. The calculator is very useful in evaluating the tax implications of a NSO.

Depending on your holding period of the stock the capital gain or loss is. The amount you received for writing the option increases the amount received from the sale of the stock. Get started Know your options.

Ad Instant access to real-time and historical options market data. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. Click to follow the link and save it to your Favorites so.

New Hampshire doesnt tax income but does tax dividends and interest. For this calculator the current stock price is assumed to be the. Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO.

This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. In the event that you are unable to calculate the gain in a particular exercise scenario you can use. There are two types of taxes you need to keep in mind when exercising options.

SBIs Multi Option Deposit Scheme is a term deposit that is linked to the ones savings or current accounts. Nonqualified Stock Option NSO Tax Calculator Nonqualified Stock Options NSOs are common at both start-ups and well established companies. Visit The Official Edward Jones Site.

Enter up to six different hourly rates to estimate after-tax wages for. Including trades quotes aggregates and reference data. On this page is a non-qualified stock option or NSO calculator.

Say in total you have. Build Your Future With a Firm that has 85 Years of Investment Experience. The amount depends on your tax situation for the year.

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

What Is An Employee Stock Option Eso

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Cost Of Preferred Stock Rp Formula And Calculator Excel Template

Calculating Diluted Earnings Per Share

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

What Is An Employee Stock Option Eso

Cost Of Debt Kd Formula And Calculator Excel Template

Startup Equity Value Calculator By Triplebyte

Employee Stock Options Financial Edge

How Stock Options Are Taxed Carta

Secfi Alternative Minimum Tax Calculator

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

How Stock Options Are Taxed Carta

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales