Biweekly payroll tax calculator

Your average tax rate is 165 and your marginal tax rate is 297. EI Exempt CPP Exempt Total claim from Federal TD1.

How To Calculate Payroll Taxes Methods Examples More

The Paycheck Calculator below allows employees to see how these changes affect pay and withholding.

. A biweekly pay cycle means that your employees are paid every two weeks always on the same day. Its important for business owners to strike a balance between the cost of running payroll and the financial needs of their staff. The other major advantage of a 401k plan is the tax savings from pre-tax contributions.

PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada. It calculates payroll deductions for the most common pay periods such as weekly or biweekly based on exact salary figures. There is a one-week lag for annual and two-week lag for hourly employees.

Social Security biweekly tax deposits quarterly adjustment reports and annual W-2 information. A word of warning. You can use our Payroll Deductions Online Calculator PDOC to calculate payroll deductions for all provinces and territories except Quebec.

This template takes into account that typically overtime pay is the employees regular rate. Once you have the adjusted annual wages you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount. Account for dependent tax credits.

Finally the payroll calculator requires you to input your employees tax information including any entitled credits along with year-to-date Canada Pension Plan CPP and Employment Insurance EI contributions. State Disability Insurance SDI 05. The tool then asks you to enter the employees province of residence and pay frequency weekly biweekly monthly etc.

Payroll Time Attendance Benefits Insurance 833-729-8200. IRS Publication 15 Circular E has a complete list of payments to employees and whether they are included in Social Security wages or subject to federal. You can try it free for 30 days with no obligation and no credt card needed.

Use the IRS Tax Withholding Estimator to make sure you have the right amount of tax withheld from your paycheck. Your contributions to a tax-deferred retirement plan like a 401k plan should not be included in calculations for both federal income tax or Social Security tax. You can refer to the pay calendar and also use the pay rate calculator to get a better understanding.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Free 2022 Employee Payroll Deductions Calculator. Employee wages and tax.

For single people married people or people filing as the head of household. The CUMIPMT function requires the. Payroll period details including the frequency of your pay periods weekly biweekly or monthly and the amount of time for that particular period.

Employees receive 26 paychecks per year with a biweekly pay schedule. Calculate your state income tax step by step 6. Student Information System SIS How Do I Make My Tuition Payment.

If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically. Weekly pay results in 52 pay periods per year and is commonly used by employers who have hourly workers. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts.

When you hop over to Publication 15-T youll notice that the IRS lists more than just two tablesInstead it lists tables for manual or automated payroll calculations. Figure out your filing status. Biweekly payroll calendar template for 2021.

The calculator is updated with the tax rates of all Canadian provinces and territories. Yearly payroll calendar template view 2021. WASHINGTON The Internal Revenue Service today released Notice 1036 PDF which updates the income-tax withholding tables for 2018 reflecting changes made by the tax reform legislation enacted last monthThis is the first in a series of steps that IRS will take to help improve the accuracy of withholding following major changes made by.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Use this simplified payroll deductions calculator to help you determine your net paycheck. The charts below show the potential tax savings that you could miss out on by waiting.

Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. For Excel 2003. If youre fine with open-sourced software TimeTrex Community Edition offers nearly as many features as Payroll4Free with stellar time-tracking integration.

HR Services PEO 866-709-9401. Finally you can make any needed tax adjustments for dependents and determine the amount of tax per check. On his Presidential campaign Senator Joe Biden proposed also imposing the payroll tax on every dollar of income above 400000.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035. As one of the most fully featured free payroll programs for small businesses Payroll4Free is our top free software recommendation. This number is the gross pay per pay period.

On August 28 the IRS issued Notice 2020-65 which allowed employers to suspect witholding and paying Social Security payroll taxes for salaried employees earning under 104000 per year through the remainder of 2020. Using our retirement calculator. Work out your.

Download the payroll calculator template for Excel. Youll need to gather information from payroll to calculate employee withholding tax. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

For daily weekly biweekly semimonthly or monthly pay schedules. The amount can be hourly daily weekly monthly or even annual earnings. Figure the tentative tax to withhold.

Coordination with members of the Information Technology Division concerning development testing and implementation of all system. HRmys free payroll app and availability in 65. Usage of the Payroll Calculator.

Biweekly payroll offers consistent pay days every month with the added bonus of two extra pay periods. Heres another example. 014 daily 060 weekly 120 biweekly 130 semi-monthly 260 monthly 3120 annually Paid Family and.

Calculating your New York state income tax is similar to the steps we listed on our Federal paycheck calculator. Heres the information youll need for your calculations. The PaycheckCity salary calculator will do the calculating for you.

You can use the calculator to compare your salaries between 2017 and 2022. The bottom line. Dont want to calculate this by hand.

East Lansing MI 48824. California government employees who withhold federal income tax from wages will see these changes reflected in 2021 payroll. Tax Calculator.

Enter your pay rate. This is where youll record the hours that go into your employees pay. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

And for employees who submitted pre-2020. Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments. Administrative employees are paid on the same schedule as the Citys biweekly payroll and pay is calculated in the same way.

Calculation Of Federal Employment Taxes Payroll Services

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Sjcomeup Com Grss Salary Calculator For Shanghai

How To Calculate Payroll Taxes Methods Examples More

Ready To Use Paycheck Calculator Excel Template Msofficegeek

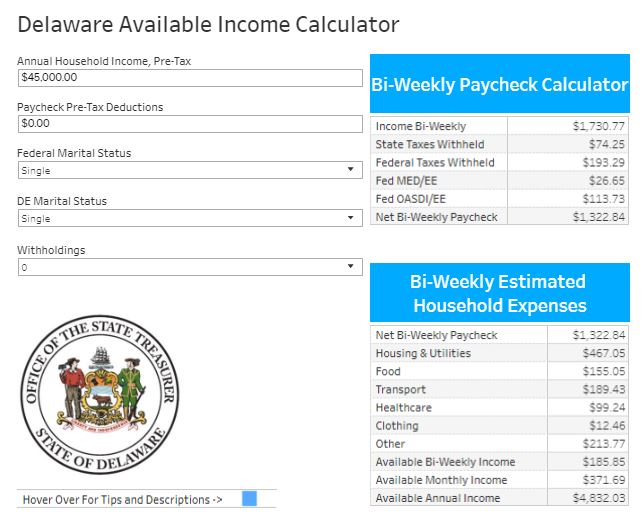

Delaware Available Income Calculator State Treasurer Colleen C Davis State Of Delaware

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Calculator Take Home Pay Calculator

Mathematics For Work And Everyday Life

How To Calculate Federal Income Tax

Calculation Of Federal Employment Taxes Payroll Services

Paycheck Calculator Take Home Pay Calculator

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Federal Income Tax